-

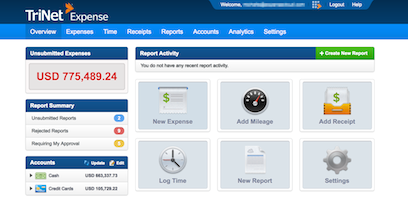

Online expense management made easy

Manage the entire expense reporting process online

Say goodbye to manual entry, excel spreadsheets, and reviewing paper receipts! With TriNet Expense, the expense report process has never been easier. Manage the entire process online by either submitting, approving, or reimbursing employee expense reports for an entire company.

-

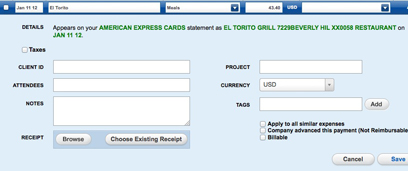

Expenses

Import from a bank, credit card, our collection of CSV formats, or enter from our mobile expense apps. Add additional information to each expense like date, merchant, category, amount, tax, tag, note, receipt, to/from, client, project, attendee, billable or reimbursable/non-reimbursable. Additionally, expenses can be entered in 160 different foreign currencies and calculated to the user's base currency.

-

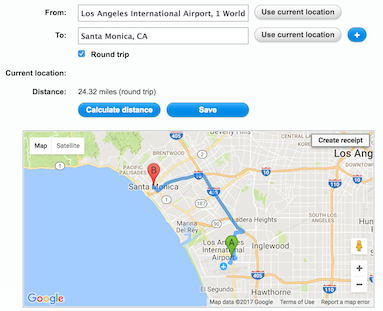

Mileage

Mileage can be easily recorded and tracked within TriNet Expense. Use Google Maps to enter in the from and to location, accurately calculating the distance driven. Record roundtrip or multiple trips if needed. The mileage direction line can be dragged to the proper route driven. Additionally, user can enter in the number of mileage driven either online or from our mobile expense apps to quickly create a mileage expenditure. All mileage is automatically calculated based on your personal or company mileage reimbursement rate.

-

Be green and eliminate paper receipts

With TriNet Expense, users can upload scanned receipts, email them to their private TriNet Expense email address, or even snap a picture when using our mobile phone applications. Never again will you or your employees have to worry about carrying a wad of receipts in their wallet or taping receipts to a piece of paper. All receipts are stored security online, backed up and accessible at any point.

-

Mobile Expense Apps

Choose from our iOS, or Android mobile phone applications to record cash expenditures, mileage, snap pictures of receipts, or edit existing expenses imported from a credit card. Editing existing expenses allows a user to capture digital receipts with a camera phone and attach directly to the expense. In addition, any data about the expense can be added, like changing the merchant name, adding project information, who attended, or if the expense was billable. TriNet Expense mobile apps also allow creating, submitting and approving expense reports to a company approver, bookkeeper or integration like Intacct and NetSuite.

-

Auto-Import expenses from over 5,000 credit and bank cards.

Choose from 5,000 credit and debit cards, securely downloaded every day. Best of all, our technology will categorized and display the expenses properly for the expense report or client invoice. TriNet Expense also supports a variety of corporate credit cards like American Express or Citibank, with an optional feature to mark each expense non-reimbursable when imported.

-

Currency Conversion

TriNet Expense supports 160 currencies both online and with our mobile apps, including historical FX rates. Each currency is automatically converted to the company base currency. Also supported is the ability to alter conversion rates and currency increases (i.e. bank fees).

-

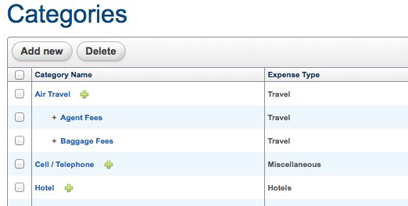

Custom Expense Categories

TriNet Expense comes setup with a list of standard expense categories commonly seen. This list can be completely customizable to match the needs of your company, including support for sub-categories and displaying certain fields based on the category. Additionally, TriNet Expense can import expense categories (Chart of accounts) from accounting solutions like NetSuite, Intacct and QuickBooks.

-

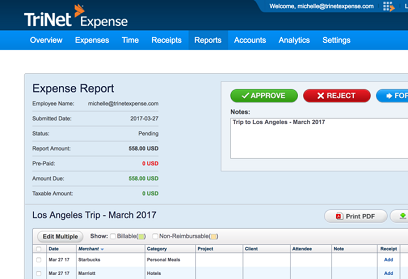

Expense Report Approvals At Your Fingertips

TriNet Expense supports the ability to approve employee expense reports online. Approvers can be set up by the company administrator or the submitter by simply adding a valid email address. When a report is submitted, the approver will be notified by email to log into their TriNet Expense account, view the expenses, receipts, policy violations and approve/reject the expense report. There is no limit to the number of approvers and each will receive a PDF copy of the expense report template via email, including the receipts.

-

Expense Policy Enforcement

Expense policies ensure employees follow guidelines on how they should be submitting an expense report. Setting up expense policies can be added in seconds, informing both the report submitter and approvers when an expense policy violation has occurred in an expense report. This powerful feature offers setting basic policies (receipt, max amount, age, category) or creating custom polices designed to meet your company needs.

-

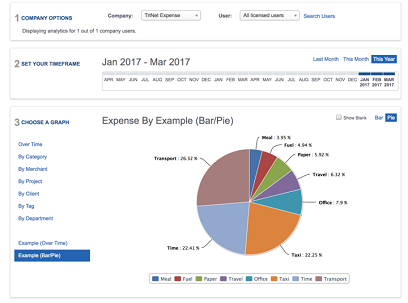

Powerful Spend Analytics

Need data at your fingertips how your company or users are spending money? TriNet Expense analytics shows detail historical spending by date range across expense categories, merchants, clients, tags, projects and users. Each report shows graphical representations of the data, that can be exported to a CSV file.

-

Taxes

Add custom tax types (ie. VAT, GST, HST) to track along with expenses. Users associated with a company can add any tax created by their administrators to their expenses, automatically calculating the taxable amount for each expense. Taxes can be tracked by individual expense, expense report or date range. Additionally, use TriNet Expense's spend analytics to track the total amount of taxes incurred by date range, subsidiary, or individual.

-

Export

TriNet Expense allows you to export expense report data directly into your Payroll, Accounting or General Ledger system. Supported integrations include NetSuite, Intacct and QuickBooks Online. Download data into PDF, CSV or XML formats for systems like PayChex, ADP, PeachTree, Great Plains (MSFT Dynamics) or Sage. Please see our integration page for a complete list of all our supported solutions.

-

Reimburse

Reimburse expense reports using TriNet Payroll or TriNet Direct Pay. Our TriNet Payroll integration allows TriNet PEO clients to export expense reports to Payroll. The expense reimbursement will be recorded on the employee's paycheck. Want to reimburse employees quicker? Utilize our TriNet Direct Pay ACH Reimbursement for an additional monthly cost. Expense reports are processed and paid out through direct deposit within 4-5 business days.

“TriNet Expense has streamlined my monthly expense reporting from days to minutes with its automatic link to my online statement and real-time receipt capture”

Create, Submit & Approve Online Expense Reports, Including Mobile Apps!

All these features are available in your TriNet Expense account.